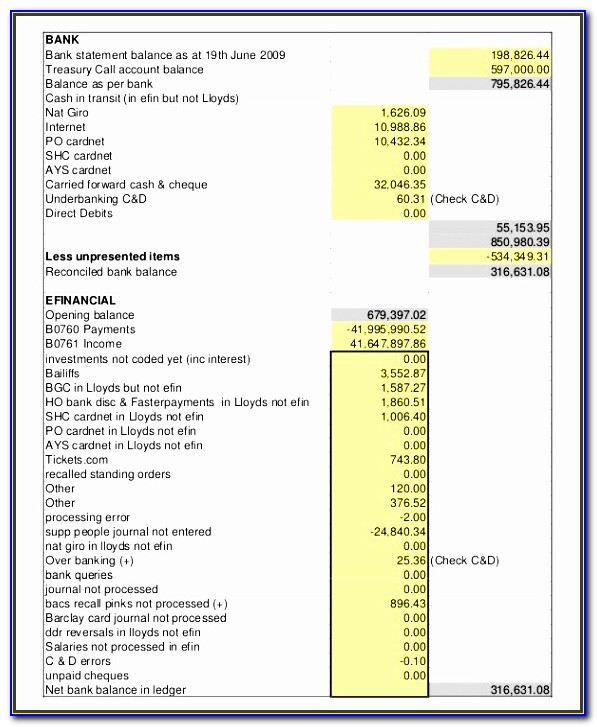

If they deposit their paychecks themselves, compare their take home pay with their check deposits. Once you have the applicant’s bank statements from the previous 30 to 90 days, compare the pay amount and employer on their direct deposits with the details on their bank stubs. The increase in the number of undetected fraudulent applications can partly be attributed to the difficulty in detecting fraud when documents are uploaded via online applications. One in 10 fraudulent applications used to go undetected. In fact, it’s worsened during the pandemic, according to Snappt’s “2020 Effects of the COVID-19 Pandemic on Residential Rentals Survey.” The percentage of fraudulently altered applications has increased from 15% before the pandemic to 29% in September 2020. Unfortunately, the problem of fake bank stubs being submitted with rental applications hasn’t gone away. How to fight fraudulent rental applications We are going to offer some tips on how you catch these fraudsters before they become an issue. Or, if you would rather receive a specific physical statement copy, you can either call the bank or visit your local branch to discuss your options with a Chase bank employee.Prospective tenants can use fake bank stubs to misrepresent their finances on rental applications, costing property managers thousands in losses. If you don’t want to view your statements digitally, you can still opt to receive monthly statements via the mail. If you need a statement dating further back than those seven years, you may need to contact the institution directly for assistance. Chase offers customers access to up to seven years of statement information. Then, you can view and download your statement. You will find this option below your account balance. From there, a menu will populate with statement options you can click. Then, navigate over to the account you wish to view.

Customers can also access their statements from the convenient mobile app if they’re on the go but need to take a quick peek.įor access either from the mobile app or website, you need only follow the same simple steps.

On Chase’s website, customers can access their Chase bank statement from any of their open accounts.

0 kommentar(er)

0 kommentar(er)